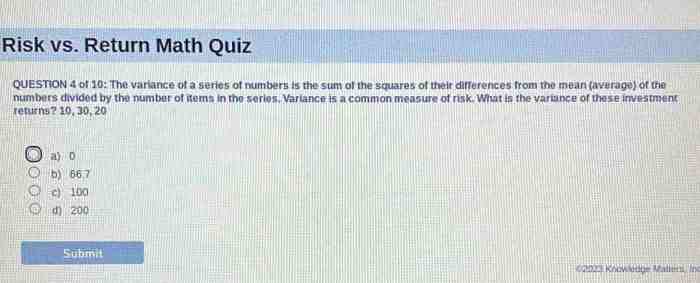

Embark on a mathematical journey with our Risk vs. Return Math Quiz, where we delve into the intricate relationship between risk and reward in the realm of investments. Brace yourself for a captivating exploration of the formulas and concepts that govern the delicate balance between potential gains and potential losses.

As we navigate this quiz, you’ll unravel the secrets of high-risk, high-return investments, the power of diversification in mitigating risk, and the significance of risk tolerance in shaping investment decisions. Get ready to sharpen your financial acumen and emerge as a master of the risk vs.

return equation.

Risk and Return Relationship

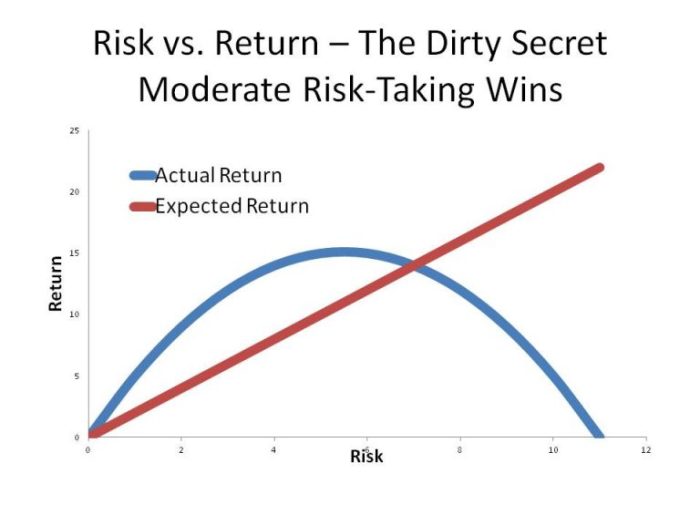

In the world of investments, there’s a fundamental relationship between risk and return. Generally, the higher the potential return, the higher the risk involved. This is because investors demand compensation for taking on additional risk, which is reflected in the form of higher returns.

High-Risk, High-Return Investments

Examples of high-risk, high-return investments include:

- Venture capital: Investing in early-stage startups with high growth potential but also high failure rates.

- Emerging market stocks: Stocks of companies in developing countries, which offer higher potential returns but also greater political and economic risks.

- Commodities: Raw materials like oil and gold, which can be volatile and subject to market fluctuations.

Diversification and Risk Reduction

Diversification is a strategy to reduce risk by spreading investments across different asset classes and investments. This is because different assets tend to perform differently in different market conditions. By diversifying, investors can mitigate the impact of losses in any one particular investment and potentially enhance their overall return.

Mathematical Models for Risk vs. Return

To quantify the relationship between risk and return, several mathematical models have been developed. These models provide investors with a framework to assess the trade-off between risk and potential reward.

Sharpe Ratio

The Sharpe ratio is a widely used measure of risk-adjusted return. It calculates the excess return (return above the risk-free rate) per unit of risk (standard deviation of returns).

Trying to understand the risk vs. return math quiz? Some things in life are just like craters on Venus : big, bold, and a little bit mysterious. But don’t worry, the math quiz is not that complicated. Just like studying those craters can help us learn about Venus’s past, understanding the risk vs.

return math quiz can help you make informed financial decisions.

Sharpe Ratio = (Expected Return

Risk-Free Rate) / Standard Deviation

A higher Sharpe ratio indicates a more efficient portfolio, as it generates a higher return for a given level of risk.

Treynor Ratio

The Treynor ratio is similar to the Sharpe ratio, but it measures the excess return per unit of systematic risk (beta). Systematic risk is the risk that cannot be diversified away through portfolio diversification.

Treynor Ratio = (Expected Return

Risk-Free Rate) / Beta

The Treynor ratio is advantageous over the Sharpe ratio when comparing portfolios with different levels of systematic risk.

Jensen Measure

The Jensen measure evaluates portfolio performance by comparing it to a benchmark portfolio. It calculates the excess return (return above the benchmark) that is attributable to the portfolio manager’s skill.

Jensen Measure = Portfolio Return

- Benchmark Return

- (Beta

- (Benchmark Return

- Risk-Free Rate))

A positive Jensen measure indicates that the portfolio manager has outperformed the benchmark, while a negative measure suggests underperformance.

Risk-Return Trade-Off in Investment Decisions: Risk Vs. Return Math Quiz

When making investment decisions, understanding the relationship between risk and return is crucial. Investors seek to optimize their portfolios by balancing potential returns against the level of risk they are willing to take.

Risk Tolerance

Risk tolerance refers to an investor’s ability and willingness to withstand potential losses. It is a key factor in determining an appropriate investment strategy. Factors influencing risk tolerance include age, financial situation, investment goals, and personality.

Strategies for Optimizing Risk and Return

Investors can employ various strategies to optimize risk and return in their portfolios:

- Diversification:Spreading investments across different asset classes, such as stocks, bonds, and real estate, can reduce overall portfolio risk.

- Asset Allocation:Determining the appropriate mix of asset classes based on risk tolerance and investment goals is essential.

- Rebalancing:Periodically adjusting the portfolio’s asset allocation to maintain the desired risk-return balance is crucial.

- Risk Management Tools:Utilizing stop-loss orders, hedging strategies, and insurance can help manage risk and protect investments.

Real-World Applications of Risk vs. Return Math

Risk-return models are not just theoretical concepts; they play a crucial role in the financial industry and personal finance.

Financial Institutions, Risk vs. return math quiz

Financial institutions use risk-return models to manage client portfolios. These models help them assess the risk and return characteristics of different investments and create portfolios that align with their clients’ risk tolerance and financial goals.

Asset Allocation

Risk-return analysis is essential in asset allocation decisions. Investors use these models to determine the optimal mix of assets (e.g., stocks, bonds, real estate) in their portfolios. The goal is to achieve a balance between risk and return that meets their individual needs.

Retirement Planning

Retirement planning involves careful consideration of risk and return. Individuals need to ensure their retirement savings are invested in a way that balances growth potential with risk management. Risk-return models help them make informed decisions about how to allocate their retirement assets.

Expert Answers

What is the Sharpe ratio?

The Sharpe ratio is a measure of risk-adjusted return that compares the excess return of an investment to its standard deviation.

What is the Treynor ratio?

The Treynor ratio is a measure of risk-adjusted return that compares the excess return of an investment to its beta.

What is the Jensen measure?

The Jensen measure is a measure of portfolio performance that compares the return of a portfolio to the return of a benchmark.